Storm Damage and Insurance Policies

Get the Most Out of Your Homeowner's Insurance Policy

Honest

Personable

Fair Pricing

We Stand By Our Work!

Handling Your Storm Damage Insurance Claim the Right Way

Storms can consist of harsh winds or heavy rains that can all damage your home or commercial property, especially the roof. The materials on your roof are meant to protect against water getting in, because the other layers and your property are susceptible. Any damages to your roofing can cause issues with your underlayment and roof deck, like mold or infestation.

In the event of storm damage, it’s crucial to file an insurance claim as fast as you can. The claims process can be more complicated than people expect, and choosing a contractor can be overwhelming. At Cost Pro Construction, we’re here to assist you throughout the process and make sure you get the most for your roof repair when you call us today!

Preparing Documentation for Your Claim

If your residential or commercial roof goes through a bad storm, it’s important to know what to do first. Documentation is key, so photograph any signs of water stains, spots, or other storm damage to your property. Even if the damage is severe enough to warrant a roof replacement in Bergen County, NJ, your insurance company may find a way to avoid covering the costs without proper documentation and photographs.

Any pre-existing issues with your roof could be regarded as negligence or cosmetic wear. That’s why it’s important to contact us as soon as possible after a storm to maximize your claim for roof repair or replacement. Our experts can guide you on what to document and take pictures of to support your claim.

Before the insurance company’s adjuster comes for the damage assessment, take as many pictures of the storm damage as you can. Whether it’s cracked shingles or missing sections, documenting everything can help you secure at least partial coverage. Keep all your documentation readily available to give a copy to the adjuster when they arrive.

Get in Touch with Your Insurance

After documenting the damage to your roof, it’s essential to contact your insurance provider quickly. Putting off the call too long might give the impression that your home or business doesn’t need urgent repairs, or invalidate your claim completely. You shouldn’t delay or postpone contacting your insurance provider when a storm damages your property.

Find the Best Roofing Contractor

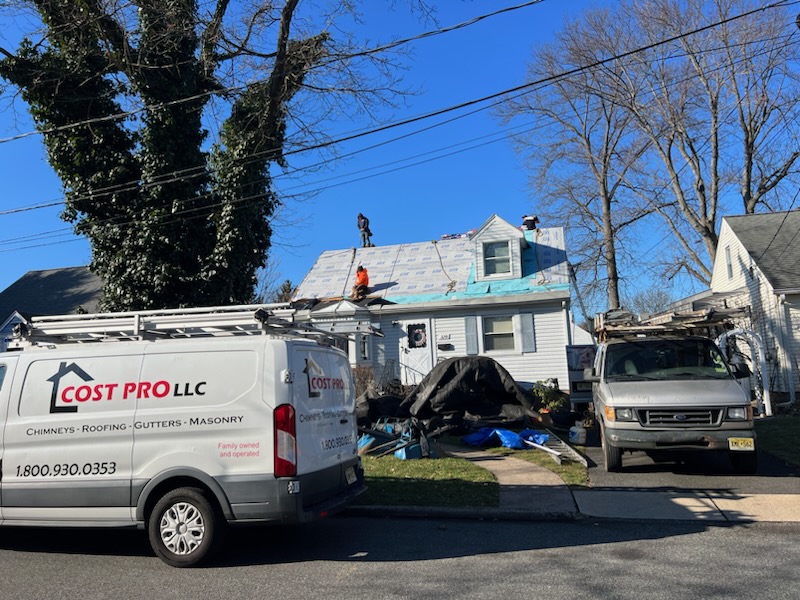

Once you’ve filed for your storm damage insurance, you’ll need a roofing contractor you can trust. Cost Pro Construction is a top provider for roofing services, from basic repairs to complex roof replacement. Our team has a lot of experience with both residential and commercial roofing, including gutter replacement in Bergen County, NJ, since a lot of people choose to upgrade their gutters while replacing their roof.

Our trained roofers will inspect your property for any signs of water damage. This could be in the form of something small, like cracks in the shingles, or a major safety concern, like exposed underlayment or weakened decking. All of these problems can allow moisture into your home or business. That’s why we’ll check common areas first, like the ceiling and walls, for wear.

Roof, wind, and water damage are common ways storms can impact your home or business. Your insurance company might have a contractor they go through, but restoration services don’t fall under that requirement. That means you can choose Cost Pro Construction and know that you’re getting the best services for your protection.

Unfortunately, so many home and business owners fall for contracts with a “managed repair program” clause. This means that any property damage covered by the policy has to use their contractor, limiting your choices. If you notice that on your policy, we strongly suggest not signing it and finding another insurance carrier.

What’s the Next Step?

Assuming that you’ve received reimbursement from your insurance claim, which can take months, you will have options for roof repair in Bergen County, NJ. Whatever your decision, you shouldn’t attempt to do your own repairs. Not only could you slip and injure yourself, but you could make the roofing damages worse and more expensive to fix.

Professional roofers at Cost Pro Construction have experience and liability insurance to make sure you get the best protection. We’ve worked on all types of homes and businesses. Our experts will inspect your roof and property for storm damage concerns, especially water damages. Once we’re done, we’ll recommend what materials would be best for your needs.

There are many benefits to hiring a professional roofing contractor like Cost Pro Construction. We offer multiple services to secure your home or business with reliable results. Our team works quickly to identify and diagnose storm damages, because we know another storm could be on the way. Call us now when you need our expertise!

Filing for Claim Reversal

Storm damage to your property can result in substantial expenses. Filing for a claim is a great start, but it doesn’t guarantee that you’ll have your roof repair or replacement fully covered. In many cases, you’ll only receive partial coverage because insurance carriers and their adjusters try to cite wear and tear on your home or business before the storm.

That’s one reason it’s so important to keep receipts and emails of any work you’ve had done on your roof. It might be simple maintenance to serious repairs, but it all means that you’ve invested in your roof without negligence. If partial coverage is all you get, you have the right to a claim reversal filing. We’ll help you get the most for your insurance claim when you call us today!

Make the Most of Your Storm Damage Insurance Claim

We know how stressful storm damage can be on your home or business, and we want to help. Cost Pro Construction has experience with professional roofing services and insurance claims. Because of that, we can give assistance toward a successful insurance and take care of any roof repairs afterward. To get started, these are 6 steps you should take for your claim:

-

Take pictures of your storm damage. If your roofing materials are pulled off or damaged, document it. Finding water stains on your ceiling or other water damages should be documented as well. Storm damages can show up in many forms, which is why our experts can help recommend what to photograph. You should also retain any receipts or emails regarding roof maintenance and repairs you’ve had done. Make copies of everything, put them in a folder, and prepare that folder for the adjuster your insurance will send.

Have text alerts turned on throughout the process. Modern technology allows insurance companies to stay connected easier. A lot of them utilize SMS or text alerts to let you know the status of your claim, since the process can take months. You could find out an estimate of coverage and when you’ll see it with an alert. You’ll know you’ve set it up right when you file your claim, which should send a text.

- File your storm damage claim quickly. The longer you delay your filing, the less likely you’ll have a successful claim. If it takes too long, your claim might be ignored or invalid. Any special needs by your family should be noted, because that could help your processing time. Make sure to date and evaluate any evidence of storm damage

- Have a storm damage claim journal. This can be incredibly useful when, months later, you’re trying to file a claim reversal or remember something. Any interaction about your claim should be written down in this journal. Make sure to indicate the name of the person, their title, the date, time, and how to reach them.

- Don’t get rid of anything until you’re told to. Because the process can take a while, it’s good to hold onto storm damaged property until the claim is done. If there’s a legal reason to discard something, record detailed information and photograph the item first.

- Be aware of emergency services in your area. If your roof’s damaged, it can leave the underlayment and decking susceptible to leaks and flooding. Emergency services can cover your roof with a tarp or extract water from your home or business. They might also offer financial assistance for living expenses if your property is deemed unlivable after storm damage.

There’s no reason to delay getting help from us and contacting your insurance carrier after a storm. Residential and commercial property can be devastated or weakened by storm damage, especially if it’s ignored or not found. Cost Pro Construction has a team of experts to keep you protected with the best roof repair or replacement.

We’ve been doing this long enough to know how to navigate the process of an insurance claim. We want to help you maximize coverage and secure your property. If there are any signs that you’ve got water damage after a storm, give us a call today and let us take care of your roof repair or replacement!

A Top Rated Roofing, Masonry, & Chimney Contractor

“Greg called immediately saw the job and started work the next day. He was honest with what he said and the job was finished and cleaned efficiently. Highly recommended.”

Mary L.

Cost Pro Construction

I needed my chimney repointed and to check for a water leak at the chimney flashing. Greg came out to take a look, told me what i needed to do and gave me an estimate. I was very impressed with Greg and his honest approach. His crew come out and did an amazing job. My 120 year old chimney looked like brand new. They also took care of sealing the flashing to the chimney. So in summary, they did an amazing job of repairing my chimney and solved the water leak i had too. I would highly recommend them. Oh, and they came exactly when Greg said they would.

-Chris K.

Why Choose Cost Pro Construction?

A Top Rated Roofing, Masonry, & Chimney Contractor

Fair Pricing

When we give you a price - it sticks! So you don't have to worry about surprise charges later on.

Honest

Our clients regularly mention how honest, straightforward, and transparent we are.

We Stand By Our Work

We stand by our work, so you don't have to worry about a ton of problems when we're done.

Over 15 Years Experience

We've seen pretty much everything you can imagine when it comes to roofing, gutters, chimneys, and masonry work.

Work With The Owner

Get the peace of mind that comes with working directly with the owner and knowing the job is done right the first time.

10% Discounts Available for Seniors*

*Ask for details.